The subscription e-commerce market is expected to reach $904.2 billion by 2026. Despite those projections, many consumers are already experiencing subscription fatigue.

With the average consumer managing 12 media and entertainment subscriptions simultaneously, providing a user-friendly way to track and adjust all their subscriptions can help you set your company apart as a leader in the financial sector.

What is a subscription management tool?

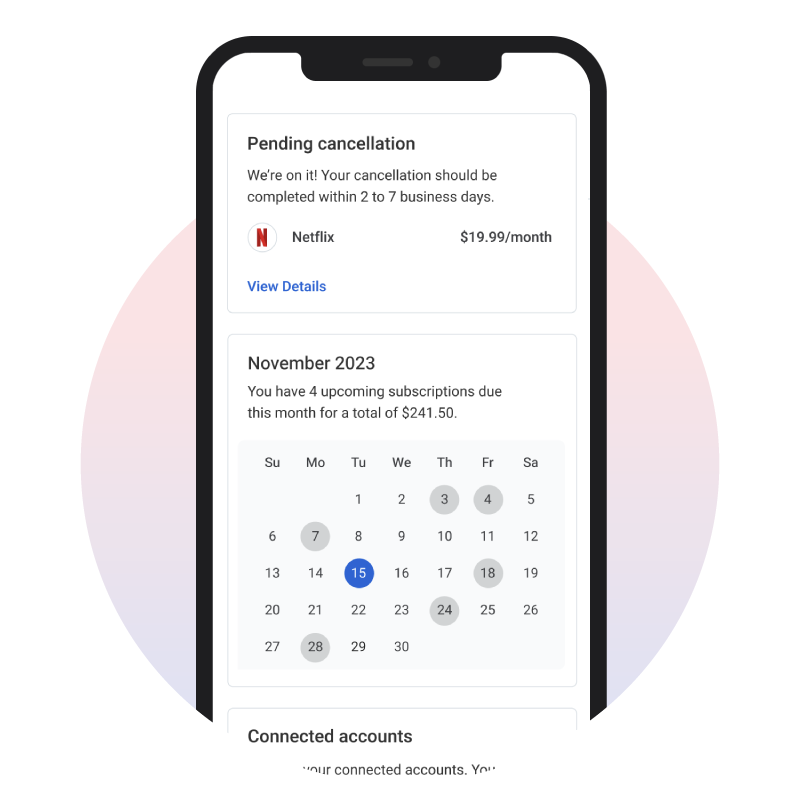

A subscription management tool brings all components of subscription services into a single dashboard. It gives your customers centralized visibility to their list of current subscriptions and their recurring costs. For the best customer experience, leading subscription management platforms provide the ability for your customers to cancel any unwanted subscription directly.

The benefits of adopting subscription management software include:

Benefit 1: differentiating your company from the competition

The financial sector changes at a rapid pace, and finding ways to leverage your company's unique selling points (USPs) is essential for staying competitive. Launching a subscription management tool in your online experience can establish your company as:

Customer-focused: Features like subscription management tools provide additional value to the customer, which shows you care about delivering quality service.

Innovative: Financial institutions are still in the early stages of integrating subscription management tools into their existing services, so offering your own can help you build a reputation as an industry leader.

Forward-thinking: Adding to and upgrading your existing service list demonstrates your commitment to continuous improvement, which is essential for long-term success in a constantly shifting industry.

By eliminating the need to spend valuable time and resources developing and deploying your own solution an embedded subscription management platform significantly shortens time-to-market. You'll be able to realize the benefits of your solution in just a fraction of the time a traditional model would take.

Benefit 2: enhancing the customer experience

In one recent Forrester study of U.S. banking customers, 47% of participants said subscription management tools would be a useful feature in online banking experiences. The average customer has at least five retail subscriptions, most of which they manage through disparate systems. Without centralized visibility into their subscriptions, it's difficult to remember which subscriptions are still active.

A subscription management tool puts some of that agency back into their hands by:

Providing visibility: By bringing all of a customer's subscriptions into one centralized location, subscription management features give customers a better understanding of their usual expenses.

Simplifying management: Your customers can use the subscription management tool to review and cancel subscriptions directly within your app or online experience, eliminating the need for long calls to customer service.

Cutting costs: With a tap or a click, customers can easily cancel subscriptions they're not using or request negotiations for better rates. These features can save them as much as $100 to $400 each year.

By providing your customers with greater transparency and control over their accounts, you can gain their trust and build more loyal customer relationships.

Benefit 3: unlock new revenue streams

Leveraging a subscription management solution as a premium offering within your existing online experience unlocks new potential for revenue generation. For example, you may have several different account tiers your customers can choose from, where each tier offers different features. Including your subscription management feature in one of the higher tiers can motivate customers to upgrade their accounts, increasing your incoming cash flows.

The key is choosing a subscription management product that clearly adds value to the customer experience. Ideally, it should operate seamlessly with the rest of your online platform so your customers get one unified experience.

Additionally, customers need to see their purchase is worth the money before they invest — providing proof through testimonials or reports can help motivate them to take advantage of this feature.

Help users control costs while unlocking new value for your business.

What to consider when choosing a subscription management platform

To choose the best subscription management tool for your business, consider the following factors:

Ease of use: Choose a subscription management platform that is intuitive and easy to use for both your company and your customers. The right platform will simplify complex processes and promote a better user experience, helping you retain customers and increase productivity.

Integration abilities: The right subscription tracking software should integrate with your existing customer relationship management (CRM) platform. That way, you can easily access customer data to personalize the subscriber experience. Choose a platform with embeddable components to seamlessly implement and launch the software.

Customizability: Consider a platform that allows you to customize your subscription models and other services. With a more flexible system, you can attract and retain customers while offering a personalized service.

Pricing: You'll want to consider your budget and other financial factors before choosing a subscription management platform.

Array knows subscription managment

At Array, we develop embeddable financial solutions that help businesses and their customers navigate the proliferation of subscription-based services. Our organization is dedicated to providing innovative products that leverage the latest technology and concepts. It was this mission that drove us to develop our own subscription management platform—Subscription Manager.

Through the development of Subscription Manager, we learned about the nuanced factors driving the technology's demand and production. Our leadership team gained a thorough understanding of the reasons businesses and their customers need modern subscription management options and the inner workings of an effective subscription management tool.

By understanding the core value that a subscription management platform can provide and the critical features it should offer, we built one of the most prominent solutions on the market. Our firsthand experience with subscription management technology—along with our commitment to each client's success—means that we can help differentiate your organization while providing continuous value to your customers.

Boost engagement and revenue with Array

Subscription management software allows customers to control their financial lives while helping you streamline your operations. These automated tools can reduce the administrative burden on your team and improve productivity.

Choosing a platform that is suited to your company's specific needs is crucial for getting the most out of your investment. That's why we created various solutions for driving conversions, enhancing customer engagement, and unlocking new opportunities for revenue generation.

Whether you want to embed or connect to our APIs or privately label your own products, our flexible deployment options can help you meet your goals.

Our embeddable fintech platform integrates into your existing offerings, so you can monetize your traffic, convert top-of-funnel users, and diversify your offerings. Whether you want to embed or connect to our APIs or privately label your own products, our flexible deployment options can help you meet your goals. Additionally, we handle security and compliance requirements within our software, so you can have peace of mind knowing your data is protected.

To learn more about our solutions and how we can help you drive growth while offering the most benefit to your customers, contact us today.

Offer a seamless subscription management experience.

Book a 15-min call.

Disclaimer: Array takes pride in ensuring the information we share is accurate and up-to-date; however, we understand that the information you read may differ from the product(s) and/or service(s) mentioned. We present the product(s) and/or service(s) you read about without warranty. We recommend you review the product and/or services’ terms and conditions before you make a decision. If you encounter inaccurate or outdated information, let us know by writing to: info@array.com.

Editorial Note: This content is the author’s opinion, expression, and/or recommendation(s).

Tags:

Thought Leadership

Post by Deepak Sharma

Deepak Sharma is an accomplished technology executive and financial expert currently leading Array's Digital Financial Management group. With a robust tenure spanning more than 15 years across leading firms like Envestnet | Yodlee, Google and AMD, Deepak is an expert in product management, strategy and business operations.

Prior to his current role at Array, he served as the Vice President of Product at Envestnet | Yodlee, overseeing digital innovations in financial services for over 4 years. His career trajectory also includes impactful positions such as the Head of Product at Aliya, Director of Business Operation and Corporate Development at Infinera, and early roles in equity research and investment banking at firms like Merrill Lynch and Connective Capital Management.

Deepak holds an MBA from Stanford University, MS in Electrical and Computer Engineering from The University of Texas and BS from Indian Institute of Technology-Kanpur. Deepak has published 15 papers and owns 2 patents.

Prior to his current role at Array, he served as the Vice President of Product at Envestnet | Yodlee, overseeing digital innovations in financial services for over 4 years. His career trajectory also includes impactful positions such as the Head of Product at Aliya, Director of Business Operation and Corporate Development at Infinera, and early roles in equity research and investment banking at firms like Merrill Lynch and Connective Capital Management.

Deepak holds an MBA from Stanford University, MS in Electrical and Computer Engineering from The University of Texas and BS from Indian Institute of Technology-Kanpur. Deepak has published 15 papers and owns 2 patents.