For consumers struggling with mounting debt, it can feel overwhelming. Fortunately, debt settlement programs offer a viable solution for those seeking relief from the burdens of unpaid bills and high-interest loans. By negotiating with creditors to reduce the overall amount owed, these programs can help consumers regain control of their financial futures.

Debt settlement programs provide a structured and strategic approach to managing debt. Instead of juggling multiple payments and dealing with relentless interest accrual, these programs consolidate efforts into one manageable plan. This not only simplifies finances but also significantly reduces the total debt, often by negotiating a lump sum payment that is less than the full amount owed.

Additionally, participating in a debt settlement program can pave the way for rebuilding credit. While the process may initially impact a consumer’s credit score, successfully settling debts can ultimately lead to improved creditworthiness.

Eliminating debt is an incredible achievement but it also represents just one step towards comprehensive financial freedom. Neglecting to also rebuild credit after they’ve graduated from a debt settlement program can leave consumers trapped by the limitations of a poor credit score. A holistic approach that addresses both debt and credit issues is key to a truly fresh start.

What are credit builder loans

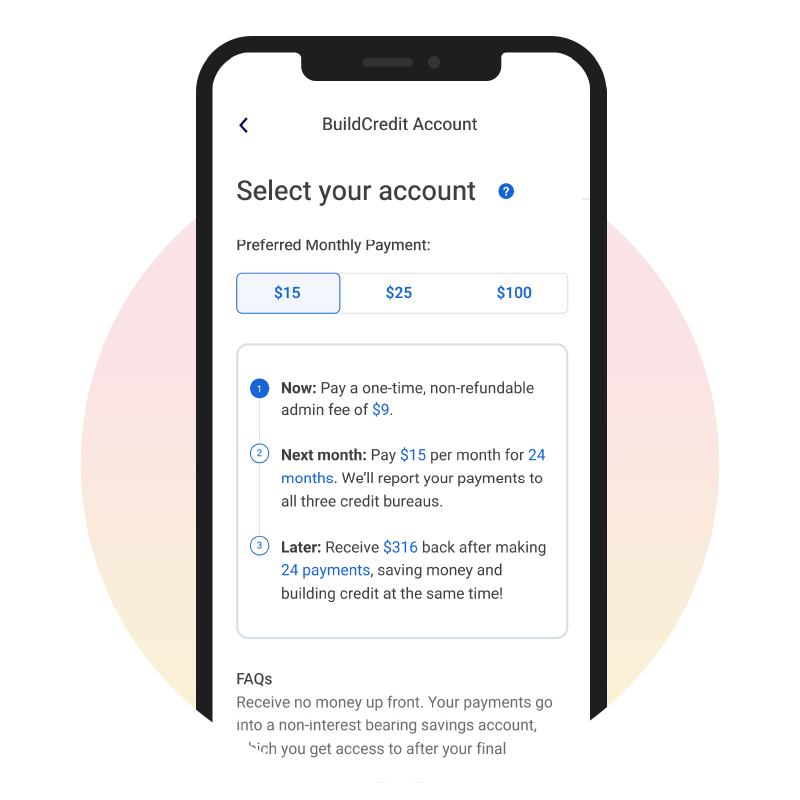

Credit builder loans are a type of loan product designed to help individuals with poor or no credit history build or rebuild their credit scores. Unlike traditional loans where you receive money upfront, with a credit builder loan, you make monthly payments into an account for a set period, typically 12-24 months. The lender reports these payments to the major credit bureaus as installment loan payments.

At the end of the loan term, you receive back the total amount you paid into the account, minus interest and fees. This unique structure serves two purposes: it helps you build savings while simultaneously establishing a positive payment history and growing your credit.

The process works like this:

01

Application

You apply for the credit builder loan, providing personal information and undergoing a soft credit check. There is typically no hard inquiry that could negatively impact your credit score.

02

Loan Amount and Term Selection

You choose the loan amount you can afford, generally ranging from $300 to $3,600, as well as the repayment term of 6 to 24 months. This determines your monthly payment amount.

03

Account Setup

The lender sets up a certificate of deposit (CD) or secured deposit account in your name for the total loan amount. You cannot access these funds during the loan term.

04

Monthly Payments

You make fixed monthly principal and interest payments, which are reported to the credit bureaus. On-time payments help build your positive payment history.

05

Credit Monitoring

Many programs also provide access to credit monitoring tools so you can track your credit score improvements over time.

06

Loan Completion

After successfully making all payments, you receive the original loan amount back, minus interest and fees paid. Your credit scores will ideally show an increase from this established payment history.

Customers who complete credit builder loan programs often see credit score improvements, depending on their starting credit profile. This boost can unlock better rates for future loans, credit cards, mortgages, and other financial products that rely heavily on credit scores.

Benefits for debt settlement companies

Offering credit builder loans as an additional service provides significant value for debt settlement companies and their customers. By helping clients not only eliminate debt but also actively rebuild their credit, debt settlement firms can provide a more comprehensive solution for achieving lasting financial health.

For the debt settlement company itself, credit builder loans represent a new revenue stream opportunity. While the core debt settlement program generates revenue, credit builder loans allow firms to earn additional income through a revenue share model with the credit builder loan provider. This incremental revenue can improve overall profitability and growth potential.

Perhaps more importantly, providing credit rebuilding solutions can lead to improved customer satisfaction and retention. Clients who go through debt settlement only to find themselves still struggling due to poor credit scores may feel the service was incomplete. By proactively offering a credit rebuilding solution upon graduation from debt settlement, firms show they care about their customers' full financial journey. This level of commitment builds trust, loyalty, and referrals.

Debt settlement companies can market the availability of credit builder loans as a key differentiator and added value versus competitors. Having a guided path from debt elimination to credit rehabilitation positions the firm as providing best-in-class, comprehensive service. For customers worried about their credit future after debt settlement, this offers tremendous peace of mind.

Your customers want more than relief–they want a way forward.

Integrating credit builder loans

Introducing credit builder loans at the right time and in the right way is crucial for maximizing adoption among your debt settlement clients. Here are some tips for seamlessly integrating this offering:

Optimal Timing

The ideal moment to promote credit builder loans is towards the end of a client's debt settlement program. As they approach debt freedom, they become primed to start taking positive steps to rebuild their credit. Presenting the credit builder loan option 2-3 months before program completion allows you to plant the seed early.

Lead with Education

Many clients may be unfamiliar with credit builder loans. Start by educating them on the importance of good credit and how these products can help boost their scores in a risk-free manner.

Make It a Natural Next Step

Position the credit builder loan as the logical next phase after achieving debt freedom. Your client has demonstrated their commitment to financial responsibility - now it's time to leverage that momentum. Frame it as an opportunity to maximize the benefits of all their hard work.

Leverage Graduation Communications

Time promotional emails and communications around a client's debt settlement "graduation." This is a celebratory moment when they'll be most receptive to next steps. Include a credit builder loan pitch along with their program completion details and success metrics.

Offer Incentives

Consider bundling the credit builder loan with discounts on other products/services you offer, like credit monitoring.

Embrace Omnichannel Outreach

Use a blend of email drip campaigns, direct mail, and personal phone calls from debt coaches to really drive the credit builder loan message home. The more engagement channels utilized, the higher the conversion rates.

By making credit builder loans a natural continuation of the client journey and meeting customers with education and incentives, you'll maximize adoption and deliver immense value to those you serve.

Credit builder loan requirements

To qualify for a credit builder loan program, applicants must meet certain eligibility criteria and go through a comprehensive identity verification process known as Know Your Customer (KYC). This helps ensure compliance with regulatory guidelines and prevents fraud or misuse of the program.

Firstly, applicants cannot be currently involved in an active bankruptcy case. A bankruptcy filing would automatically disqualify someone from being approved for a credit builder loan. The reasoning is that the loan technically still involves taking on new debt, even if the customer retains the principal amount paid.

Beyond bankruptcies, the KYC process checks applicants against government watchlists like the Office of Foreign Assets Control (OFAC) list. Any matches to these restricted parties lists would prevent account opening to comply with anti-money laundering and counter-terrorism financing regulations.

The KYC verification steps typically require applicants to provide personal details like their name, date of birth, social security number, and residential address. Discrepancies or inability to successfully verify an applicant's identity may result in denial.

While credit builder loans are generally accessible to those with poor credit or no credit history, the KYC and bankruptcy checks act as important safeguards. Satisfying these requirements helps ensure the program operates in a safe, compliant manner that mitigates risks for all parties involved.

The enrollment process

Enrolling customers in a credit builder loan program is designed to be a seamless experience, whether through self-service portals or with the assistance of a dedicated agent. The process typically begins with the customer completing an online application, providing personal information such as name, date of birth, social security number, and contact details.

For a self-service flow, the customer is directed to a personalized URL or landing page branded for the specific partner company. This page walks them through the application steps, including electronic identity verification, linking a bank account for future payments, and e-signing disclosures. Once completed, the customer is approved instantly based on predefined criteria.

Alternatively, customers can enroll through an agent-assisted channel. Sales agents guide the applicant through the same online application but remain on the line to answer any questions and ensure completion. Agents have access to the application screens, allowing them to facilitate each step while keeping the customer engaged throughout the process.

Regardless of the enrollment method, comprehensive Know Your Customer (KYC) protocols are followed, including identity verification, address checks, and screening against anti-money laundering and terrorist watchlists. While most customers qualify, certain conditions like an active bankruptcy may result in a declined application based on regulatory requirements.

Upon successful enrollment, the customer is provided with login credentials to access their account dashboard, view payment schedules, monitor their credit-building progress, and manage their personal information as needed. The seamless enrollment experience ensures a smooth transition into actively utilizing the credit builder loan product.

Monitoring performance and compliance

Careful monitoring and compliance are critical components of successfully offering credit builder loans. There are several key areas that require diligent tracking:

Measuring Credit Score Improvements

The primary goal is helping clients improve their credit scores. Robust reporting should capture starting scores across all three bureaus as well as incremental increases over the life of the loan. This data is invaluable for demonstrating the efficacy of the program and can guide optimizations.

Ensuring Regulatory Compliance

Credit builder loans involve lending regulations at both the federal and state level. Automated compliance checks must verify each loan adheres to allowable fees, interest rates, and terms based on the client's location. Audits should also review disclosures, adverse action notifications, and fair lending practices.

Auditing Loan Performance

Default and delinquency rates need to be closely monitored as negative credit events defeat the purpose of a credit builder program. Tracking leading indicators like missed payment rates can signal issues early. Periodic audits of surrendered loans should review appropriateness of funds disbursed and fees charged.

Rigorous performance tracking and compliance management are essential for the long-term viability of a credit builder loan offering. Comprehensive reporting provides key insights, mitigates regulatory risk, and ensures the program is operating as intended to truly benefit clients.

Conclusion

Debt settlement alone can oftentimes not be enough. Clients need the next step to rebuild their credit profiles and credit builder loans are a great way to help clients complete their debt freedom journey.

Support your users beyond debt relief with tools for long-term financial health.

Book a 15-min call.

Disclaimer: Array takes pride in ensuring the information we share is accurate and up-to-date; however, we understand that the information you read may differ from the product(s) and/or service(s) mentioned. We present the product(s) and/or service(s) you read about without warranty. We recommend you review the product and/or services’ terms and conditions before you make a decision. If you encounter inaccurate or outdated information, let us know by writing to: info@array.com.

Editorial Note: This content is the author’s opinion, expression, and/or recommendation(s).

Post by Clint Gausnell

Clint is an engaging and accomplished Sales Executive whose award-winning efforts have driven explosive growth in fast-paced, high-pressure environments for established and startup enterprises. He is passionate about ensuring his clients’ success by delivering highly effective global sales strategies that produce results. Clint currently leads Array's Client Services sales team and lives in UT.