When it comes to loan repayment, the traditional, one-size-fits-all approach doesn't always address borrowers’ unique financial situations. A study found that of 6 million student loan borrowers, nearly 14% were 90 or more days delinquent or in default in the first quarter of 2025. This has led to plummeting credit scores for many individuals struggling to make ends meet. Fortunately, financial technology (fintech) innovations are emerging to make the loan repayment process easier.

Using fintech for personalized loan repayment allows for a more tailored approach for borrowers, with options like income-driven repayment (IDR) plans and flexible payment schedules. The technology can also be easy to implement within your institution’s existing applications, letting you present more affordable repayment plans, acquire more users, and build loyalty among your current base.

The inflexibility of traditional repayment models

The traditional loan structure is mainly designed for those with stable and documented incomes, often based on monthly payment plans. This format makes it inflexible for many, like those with irregular incomes or facing unexpected financial hardships. A 2024 survey found that 56% of borrowers had some income variation, with 23% reporting significant fluctuations in their household income.

The primary challenges of traditional repayment models include:

Reliance on regular income

Traditional repayment models are inflexible for those with irregular incomes or anyone who experiences unforeseen financial difficulties, like gig workers and freelancers. These individuals might be unable to repay loans based on the traditional payment model, which is often based on fixed monthly payments.

Requirement of consistent documentation

Additionally, traditional lending typically relies on consistent pay stubs, W-2 forms, and tax returns to assess income. Some workers, like business owners, cannot always provide this documentation since their earnings can fluctuate a lot from month to month.

Personalized repayment plans account for

the borrower's unique financial situation,

making them more flexible than

traditional, fixed payment models.

Lack of accounting for unexpected financial issues

Traditional plans also fail to account for job loss, reduced work hours, or unforeseen expenses, such as medical emergencies and car repairs. When faced with financial difficulties, borrowers often must choose between paying for their essential needs, like food, housing, or child care, and loan payments, which can lead to delinquency and defaulting on their loans.

Benefits of personalized loan repayment plans

Personalized repayment plans account for the borrower's unique financial situation, making them more flexible than traditional, fixed payment models. For example, income-driven repayment (IDR) plans, flexible payment schedules, and pausing payments (which require deferment or forbearance) can all personalize the process and make repayment easier.

Existing fintech solutions can help analyze the borrower's financial situation more deeply than traditional methods. It can power these personalized loan repayment plans by creating plans based on the borrower’s actual ability to repay. Using fintech solutions for delinquency reduction leads to more flexible plans and helps avoid defaults, which is beneficial for borrowers and lenders alike.

Help borrowers stay on track with smarter repayment options

For borrowers

Benefits of personalized loan repayment plans for borrowers, which can include:

-

Making payments more affordable: For example, an IDR adjusts monthly payments based on the borrower's income and family size so the borrower can make payments while still caring for family and basic needs. Essentially, the monthly payments become more practical for their financial situation, often making them more affordable, so borrowers don't need to default.

-

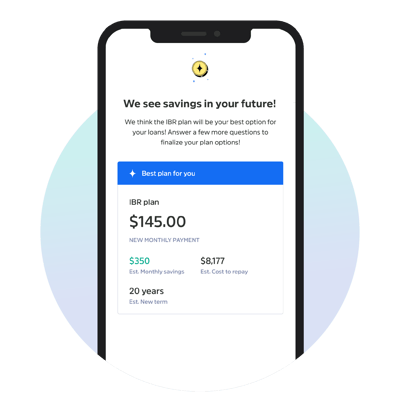

Making payments more borrower friendly: Personalized repayment plans, like IDR plans, can make the process much more borrower focused. IDR plans allow consumers to pay based on their income. Array’s Student Loan Aid guides the borrower into a qualifying IDR plan and files the federal IDR form on their behalf.

-

Preventing credit score damage: A personalized repayment plan can also benefit anyone who faces unexpected financial issues, sometimes letting them pause payments. With greater flexibility, borrowers can navigate financial challenges without damaging their credit.

For financial service providers

Customized loan repayment plans for institutions can help reduce their operational costs and improve risk assessment. Fintech platforms can automate processes to increase efficiency and lower overhead. Additionally, by helping borrowers avoid default, you can improve your institution's financial health and foster long-term customer loyalty.

This approach also expands access to credit for individuals who might be overlooked by traditional lending models, opening up new customer bases.

Benefits of embeddable student loan solutions

A beneficial offering within fintech is embeddable student loan aid solutions. The technology allows your consumers to link their student loan accounts, see suggested plans, and then choose the best options for their financial situation. It lets you present more affordable student loan repayments for your borrowers, which can help you acquire more consumers.

Borrowers can use these student loan aid solutions to lower their monthly payments, improve their credit scores, and save more. Helping your consumers get the best outcomes for their student loans means more engagement, trust, and loyalty for your business.

The future of fintech in loan repayment

The future of loan repayment will likely see even greater personalization with artificial intelligence (AI) and machine learning. These technologies can scour massive amounts of data to provide more accurate risk assessments. It can then tailor loan products to the borrower's needs. AI-driven models can also monitor a borrower's financial situation in real time, helping them adjust their loan terms so they are more likely to make payments and follow the plan in the long run.

Open banking and data aggregation will also be used more often, offering a more seamless, secure way to share data between financial institutions. Data sharing will give lenders a broader view of the borrower's financial health so they can make more informed decisions. To flourish, fintech companies must follow a clear regulatory framework to continue developing these solutions while protecting consumers.

Why trust Array for fintech solutions

Array offers embeddable fintech products for leading digital brands, financial institutions, and fintechs. Our platform empowers you to become a one-stop shop for financial services, letting you conveniently integrate crucial products into your existing applications.

Our wide range of solutions can help consumers maintain digital privacy and protect their identity, better manage their credit, and help them with their subscriptions – letting consumers own their financial future in one centralized location. Array is also backed by some of the tech world's most influential supporters, so you can feel confident in our ability to deliver quality solutions.

The one-size-fits-all approach to loan repayment doesn't work for today's diverse financial landscape. Personalized repayment plans, powered by fintech, can provide a more flexible and effective solution for both borrowers and financial services providers. With Array, you can easily embed the platform into your existing digital experience, helping you present more personalized repayment plans for your consumers.

Use fintech for delinquency reduction and better consumer engagement. Our solutions can empower borrowers to take control of their loan repayments and financial outcomes while driving acquisition and revenue for your institution.

Learn about Array’s fintech solutions and explore how they can benefit your institution

Book a 15-min call.

Related articles

Disclaimer: Array takes pride in ensuring the information we share is accurate and up-to-date; however, we understand that the information you read may differ from the product(s) and/or service(s) mentioned. We present the product(s) and/or service(s) you read about without warranty. We recommend you review the product and/or services’ terms and conditions before you make a decision. If you encounter inaccurate or outdated information, let us know by writing to: info@array.com.

Editorial Note: This content is the author’s opinion, expression, and/or recommendation(s).

Tags:

Thought Leadership

Post by Eisley Nkwonta

Eisley Nkwonta is a seasoned Sales Executive at Array, specializing in helping financial institutions, fintechs, and consumer brands embed financial wellness solutions that drive engagement, retention, and revenue growth.

Eisley has consistently delivered results by aligning Array’s platform with client priorities—ranging from credit-building and debt management to identity protection and privacy.

Fueled by the passion to empower today's consumers with access to financial tools, Eisley thrives on building long-term relationships rooted in trust, collaboration and shared growth.

Eisley has consistently delivered results by aligning Array’s platform with client priorities—ranging from credit-building and debt management to identity protection and privacy.

Fueled by the passion to empower today's consumers with access to financial tools, Eisley thrives on building long-term relationships rooted in trust, collaboration and shared growth.