We live in a world in which our personal data is constantly being shared and sold (oftentimes without our knowledge). It’s no surprise that data and privacy protection has become a top concern for consumers.

A major contributor to the mass availability of personal data online is the data broker and people search site industry. In fact, 98% of Americans have information exposed on dozens of people search sites.1 These sites are reselling an individual’s data without the direct consent of that individual, leaving their privacy and security at risk.

This flagrant violation of our privacy presents an opportunity for fintechs and financial institutions to differentiate from the competition. Organizations can address these data privacy issues by offering a robust privacy solution that can ensure the security and trust of their users—while also driving non-interest income for the business.

By prioritizing privacy, organizations can not only safeguard sensitive information, but also enhance their services, build customer loyalty, and increase conversion to premium products or bundles.

The growing threat of data brokers

One of the primary reasons why privacy protection is crucial is the existence of data brokers. These companies collect personal information from various sources with the explicit goal of sharing or selling it. Data brokers siphon our data from public records, online sources, and even non-public records such as credit card histories and internet browsing histories.

Our information is then aggregated by data brokers to create detailed profiles of individuals, which can then be used by various organizations for targeted marketing (aka spam, robocalls, etc.). While data brokerage is legal in many jurisdictions, the lack of comprehensive privacy regulation and oversight means that individuals often have limited control over how their data is collected, used, and shared.

People Search Sites are a subset of the data broker industry. These sites gather information and build records about an individual—including data like name, age, addresses, relatives, arrest records and more— and sell these records directly to consumers online. One way identity thieves use to get someone's personal information is a credit card. These bad actors can easily tie someone’s Instagram or Facebook profile to their email address, home address, phone number, relatives and even salary information. That is a major privacy and cybersecurity threat to anyone listed on these sites.

Consumer concerns and the need for privacy protection

Consumers are increasingly aware of the risks associated with their personal information falling into the wrong hands. High-profile data breaches and the misuse of personal data by companies have eroded trust in the digital ecosystem. As a result, individuals are becoming more intentional about the types of data they share and with whom, highlighting the importance of online privacy and consumer security.

A survey conducted by McKinsey revealed that consumers are more likely to share personal data that is strictly necessary for their interactions with organizations. This shows that consumers are looking to control their own data when given the opportunity—but many consumers are unaware of the sheer amount of their information that’s for sale online. Consumers are generally unaware that their information is exposed on people search sites, and find out only after performing a Google search on their name. Once they see their personal information exposed—like their age, address, legal records, family info, etc—they generally want to get it removed.

To address these concerns, fintechs and financial institutions must prioritize privacy protection as a fundamental feature of their services—showing users where their information is exposed, and giving them the opportunity to remove it. By doing so, they can alleviate consumer fears, enhance their reputation, and differentiate themselves in a crowded marketplace, while also adding a significant revenue and engagement driver.

Privacy is more than protection—it’s a trust driver and a growth lever.

The benefits of privacy protection for fintech and financial institutions customers

Enhanced Customer Trust: Privacy protection demonstrates a commitment to safeguarding sensitive information, fostering trust and confidence among users. When individuals feel their data is secure, they are more likely to engage with their fintech and financial institution vendors.

Increased Revenue: Privacy protection has shown to be a premium, in demand product offering that consumers are willing to pay for. On average, consumer willingness to pay is roughly $100–$200 per year for a comprehensive privacy product. On top of that, showing users where their information is exposed through a free scan can be a massive boost in conversion to a paid, premium product that includes info removal.

Competitive Advantage: Privacy protection can be a significant differentiator in a crowded marketplace. Companies that prioritize privacy and offer robust protection solutions will stand out from their competitors, attracting privacy-conscious consumers and gaining a competitive edge.

Improved Customer Engagement: Privacy protection can enhance the overall customer experience by providing users with a sense of security and control over their personal information. This leads to increased customer engagement and higher LTV.

What to consider for privacy protection

To effectively implement privacy protection solutions for their customers, fintechs and financial institutions must consider several key factors:

01

Adaptability to Growing Needs and a Changing Landscape

As the financial landscape evolves, so do the threats to privacy. Fintechs and financial institutions must deploy solutions that not only address current privacy concerns but also cater to the ever-changing nature of the industry. The solution should be dynamic and flexible, capable of adapting to new regulations, emerging technologies, and evolving customer expectations.

Consider implementing privacy protection solutions for your consumers that are regularly updated to stay ahead of potential risks.

02

Ongoing Commitment + Compliance

Privacy protection is not a one-time task; it's an ongoing commitment. Fintechs and financial institutions must adopt a proactive approach to their privacy offering, ensuring that whatever solution they offer to their consumers is continuously monitoring for privacy risks and vulnerabilities.

Moreover, fostering a culture of privacy awareness among employees is essential, as is choosing a partner who can meet the complex security and privacy compliance measures required by large enterprises. Training programs and communication channels should be established to keep staff informed about the latest privacy policies, best practices, and the importance of adhering to security protocols. By embedding privacy protection into the organizational culture, fintechs and financial institutions can build a resilient defense against potential threats.

03

Proven Scalability

Privacy protection solutions should be scalable to accommodate the growth of the business. As fintechs and financial institutions expand their customer base, enter new markets, or introduce additional services, the privacy framework must scale seamlessly. This involves considering the scalability of both technology infrastructure and privacy policies.

Implementing scalable technologies allows the organization to handle increased data volumes without compromising on security. Additionally, privacy policies should be designed to accommodate changes in regulations or industry standards, ensuring that the organization remains compliant while adapting to growth.

The path forward: privacy as a competitive advantage

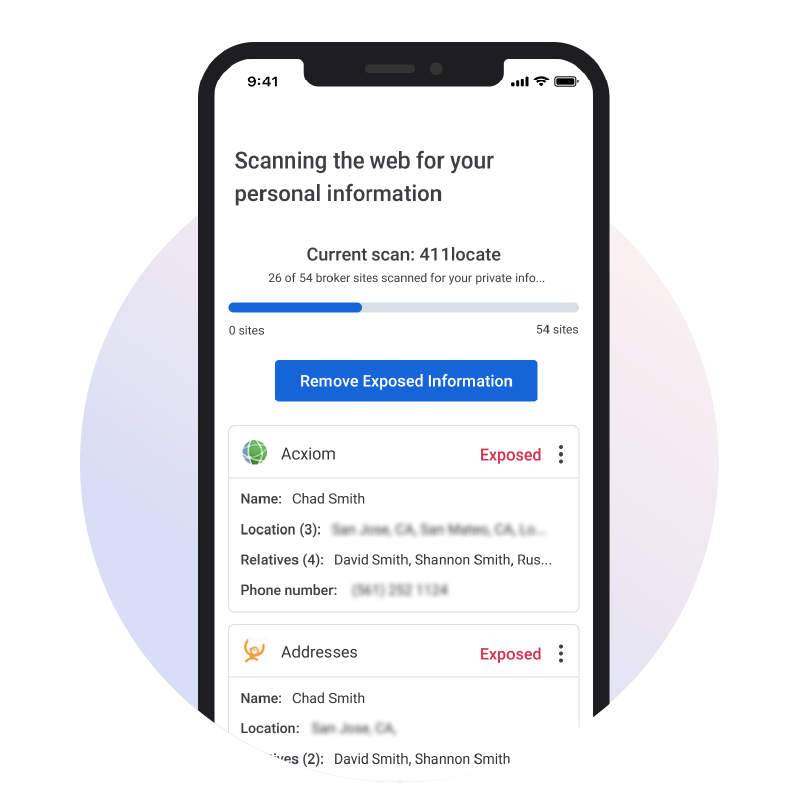

At Array, we partner with leading fintechs, financial institutions and digital brands to equip their customers with a robust privacy protection tool. Through Privacy Protect, users can:

-

Scan their names in real time to see if their personal information has been exposed and traded by Data Broker and People Search sites, and help remove it

-

Easily delete old accounts to close the door to cybercriminals

-

Improve their online privacy and reputation while optimizing their digital appearance

-

Find and address risky outdated and potentially damaging social media posts

Our clients leverage Privacy Protect to not only provide value in an increasingly privacy-less world but to generate revenue as well by framing the private labeled product as a premium offering.

“A leading automotive company saw a 303% increase in conversion to its premium identity theft protection product, even after increasing the price by 13%”

In an era where data breaches and privacy concerns are prevalent, fintechs and financial institutions must prioritize privacy protection for their users in order to remain competitive and gain market share. Investing in solutions that not only meet current consumer privacy needs but can also adapt to the changing landscape, demonstrate an ongoing commitment to users and their privacy. By prioritizing these considerations, organizations can build stronger, more durable relationships with their customers that can endure, fostering higher engagement and revenue growth—especially during turbulent times.

Show users where their data is exposed, and offer a branded path to remove it.

Book a 15-min call.

Related articles

1 Privacy Protect User and Early Partner Data

Disclaimer: Array takes pride in ensuring the information we share is accurate and up-to-date; however, we understand that the information you read may differ from the product(s) and/or service(s) mentioned. We present the product(s) and/or service(s) you read about without warranty. We recommend you review the product and/or services’ terms and conditions before you make a decision. If you encounter inaccurate or outdated information, let us know by writing to: info@array.com.

Editorial Note: This content is the author’s opinion, expression, and/or recommendation(s).

Post by Dave Carter

Dave Carter is the Vice President of Enterprise Growth at Array, specializing in boosting client engagement and driving revenue through the Array platform. With nearly two decades of experience in business development, strategic partnerships, and consulting, Dave pairs valuable insights and a proven track record of driving growth to help partners launch compelling consumer products.

Dave holds a bachelor's degree from Georgetown and an MBA from NYU. When he's not crafting growth strategies, you might find Dave in Southern Connecticut, enjoying life's roller coaster with his wife and their two rambunctious little kids.

Dave holds a bachelor's degree from Georgetown and an MBA from NYU. When he's not crafting growth strategies, you might find Dave in Southern Connecticut, enjoying life's roller coaster with his wife and their two rambunctious little kids.