As the latest reports from Javelin Strategy & Research and AARP1 reveal, identity fraud and scams have reached epidemic proportions in the United States, with American adults losing a staggering $47 billion to these crimes in 2024 alone. But behind these eye-watering statistics lies a more insidious problem: a fundamental failure of our society to prioritize the protection of personal information. As technology continues to advance at breakneck speed, we are creating new vulnerabilities and exploitability gaps that identity thieves and scammers are all too happy to exploit.

The Human Cost of Identity Theft

The impact of identity theft and scams is not just financial; it is also deeply personal. Victims often report feeling a sense of violation, shame, and betrayal, as if their very identity has been stolen from them. And for older adults, who are disproportionately targeted by these crimes, the consequences can be particularly severe. According to the Federal Trade Commission2, adults in their 70s reported a median loss of $1,000 to identity theft in 2024, compared to just $417 for those in their 20s.

The Role of Technology in Enabling Identity Theft

So, what is driving this identity theft epidemic? One major factor is the rapid pace of technological innovation, which has outpaced our ability to secure it. As the Javelin Strategy & Research report notes, “technological innovation has created new opportunities for identity thieves and scammers to operate undetected.” The rise of social engineering, for example, has made it easier than ever for criminals to trick victims into revealing sensitive information online.

A Call to Action: How Organizations Can Lead the Charge

But there is hope. By working together, we can create a safer, more secure digital landscape that protects the personal information of all Americans. Here are some key steps that organizations can take to lead the charge against elder financial exploitation:

Prioritize cybersecurity education

We need to do a better job of educating consumers about the risks of identity theft and scams, and providing them with the tools and resources they need to protect themselves online.

Implement robust security measures

Organizations must prioritize the protection of personal information, using robust security measures such as two-factor authentication and encryption to prevent data breaches.

Support stronger data protection laws

Policymakers must take action to strengthen our nation’s data protection laws, which are woefully out of date and leave consumers vulnerable to identity theft and scams.

Help protect older adults from identity theft with proactive, privacy-first solutions.

Protecting Your Organization’s Most Valuable Assets

As an organization, you understand the importance of protecting your employees’ and customers’ identities and personal information. That's why we offer two comprehensive solutions designed to help safeguard their sensitive information: Identity Protect and Privacy Protect.

Identity Protect for Organizations

Identity Protect is a robust identity protection solution that helps monitor and protect your employees’ and customers’ personal information from identity theft and scams.

With Identity Protect, your employees and consumers will have access to features including:

-

Advanced Identity Theft Protection: Alerts to any suspicious activity.

-

Social Security Number (SSN) Protection: Scan the dark web for SSN exposure and alert you to take action.

-

Non-Traditional Finance Monitoring: Alerts to non-credit loan activities including alerts on payday loans, subprime, high-cost installment, rent-to-own, and other non-traditional transactions outside of the traditional banking system.

-

Auto and Home Title Monitoring: Helps monitor for suspicious activity with auto and home titles.

-

ID Theft Insurance & Restoration: Provide 24/7 access to certified identity theft recovery specialists.

Privacy Protect for Organizations

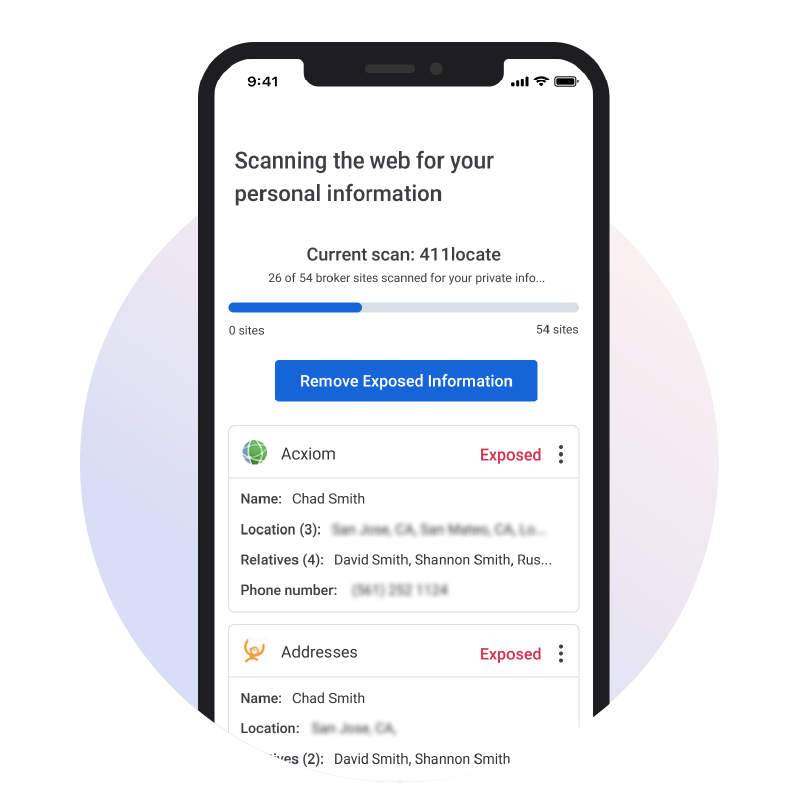

Privacy Protect is a comprehensive privacy protection solution that helps control who has access to your consumers’ and employees’ personal information online. With Privacy Protect, they’ll have access to protections like:

-

Discovery of Exposed Personal Information: We scour data brokers and people search sites to find where you have accessible information like your phone number, email address, family members that you may not want or could put you at risk.

-

Information Removal: We remove your info from those sources or opt out of its sale, by acting on your behalf to send deletion or opt out requests, or streamlining the process so you can easily remove or opt out yourself where necessary.

-

Ongoing Monitoring: We monitor these sources on an ongoing basis to ensure your information has been removed. If new information has been added, we continue to submit opt-outs or guide the user where necessary. We then re-submit opt outs or guide the user where necessary.

By implementing Identity Protect and Privacy Protect, you can help protect your consumers’ reputation and the devastating consequences of identity theft and data breaches. Don't wait until it's too late—help your consumers take control of their digital security today.

Wake Up Call

The identity theft epidemic is a wake-up call for America. It is a reminder that our nation's lack of cybersecurity is not just a technical problem, but a moral and economic one. By working together, we can create a safer, more secure digital landscape that protects the personal information of all Americans. The question is: will we take action, or will we continue to enable this epidemic of identity theft and scams?

Empower your customers with identity and privacy protection they can trust.

Book a 15-min call.

1 Javelin Strategy & Research and AARP. (2025). 2024 Identity Fraud and Scams in America Report

2 Federal Trade Commission. (2024). 2024 Identity Theft and Scams Report

Disclaimer: Array takes pride in ensuring the information we share is accurate and up-to-date; however, we understand that the information you read may differ from the product(s) and/or service(s) mentioned. We present the product(s) and/or service(s) you read about without warranty. We recommend you review the product and/or services’ terms and conditions before you make a decision. If you encounter inaccurate or outdated information, let us know by writing to: info@array.com.

Editorial Note: This content is the author’s opinion, expression, and/or recommendation(s).

Tags:

Thought Leadership

Based in the greater New York City area, Carlos is passionate about financial wellness and online safety.

He holds a BA in Psychology from the University of North Carolina at Greensboro and has studied abroad in Chile where he has family.