The world's consumer credit market will continue its upward trajectory over the next several years, reaching a projected $19.4 billion by 2030 — and with U.S. household debt reaching $17.94 trillion in 2024, consumer behavior is evolving to adapt since the pandemic began.

Overview of consumer credit behavior

As many in the financial industry will tell you, the past decade of consumer behavior is marked by a stark trifold — the years before, during, and after the COVID-19 pandemic. Similar to how the Great Recession shaped the Generation X and millennial experience, the early 2020s have altered the relationship between today's consumers and their finances.

Fintech was already growing at a rapid pace, but the replacement of face-to-face interactions with mobile banking apps and touch-free payments pushed digital tools into the spotlight as they became necessary for everyday transactions. Even as life returned to normal, the demand for a more convenient, personalized banking experience remained. The economic uncertainty created by job layoffs and a sharp rise in inflation also made the average consumer more aware of their financial well-being than ever before.

Debt repayment trends have also shifted as conditions created the perfect storm for alternative credit models — like Buy Now, Pay Later (BNPL) — to thrive in recent years.

The digital lending market is expected to

surpass $790 billion over the next five years

With negative reporting for delinquent student loans resuming and 2024 consumer prices more than 20% higher than they were in January 2020, many are left wondering what comes next. There's never been a better time for financial institutions to be proactive by investing in credit management innovation and prioritizing the consumer experience.

Key trends in consumer credit behavior

Keep these six consumer credit trends in mind as you map your strategy for the next few years:

01

Increased reliance on digital tools

As consumers increasingly rely on digital tools, these are some of the most notable things we're seeing:

Online lending platforms: Online lending platforms make it easier and faster for consumers to apply for, receive, and manage loans — it's not surprising that the digital lending market is expected to surpass $790 billion over the next five years.

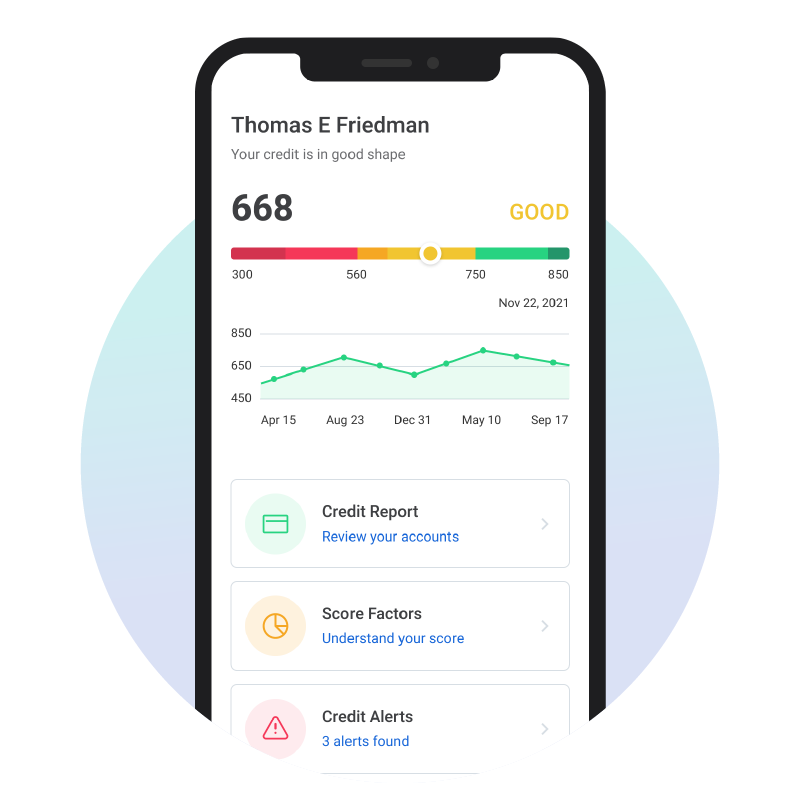

Digital credit scoring: Financial institutions are also embracing technology through digital credit scoring. Machine learning algorithms can analyze new types of consumer data — like rental payments or utility bills — to make more informed scoring decisions. While this does introduce new risks that institutions must be mindful of, it can also open up options for consumers who have no credit through traditional scoring methods.

Omnichannel experience: Today's consumers want their online banking to extend beyond their smartphones. There's a growing demand for a complete omnichannel experience that encompasses online connectivity, call center interactions, and in-person banking at physical branches. Omnichannel focuses on integrating data, conversations, and transactions seamlessly across all experiences. This is better for the consumer, but institutions also benefit from expanded repayment options. Digital tools, like cloud connectivity, help facilitate that aggregation.

Virtual assistants: The use of virtual assistants to help individuals manage their banking is growing steadily, largely due to younger consumers who have grown up with AI-powered chatbots as the norm. Institutions can implement virtual assistants to enhance the customer experience without the need for more staff to oversee simpler transactions like checking account balances or transferring funds between accounts.

Digital identity verification: Biometric authentication and electronic signatures provide an added layer of security for financial institutions and their consumers. They also bridge the gap between mobile and in-person banking, offering a faster, more convenient loan process.

Consumer credit is changing fast–offer tools that keep you ahead.

02

Growing demand for personalization and customization

Research shows that consumers are seeking a more meaningful and personalized banking experience, but many report that their current bank isn't fulfilling that need. Meanwhile, institutions that prioritize customization through tailored financial advice and guidance are seeing an increase in customer satisfaction and engagement.

When you analyze past data, what patterns do you see? For example, if people repeatedly abandon their online loan applications once they realize they have to visit a branch in person to finalize them, incorporating digital identity verification tools can mean the difference between closing the deal and losing them to a bank that offers a more convenient experience.

Consumers are more loyal to institutions that make the effort to build a transparent, trusting relationship. They're also more likely to seek out additional products and services from primary financial institutions that actively try to improve their customers' financial health.

03

Rise of alternative credit models

Alternative credit models like BNPL and point-of-sale financing give consumers — especially those with no or low existing credit — a faster, more flexible way to pay for goods. It lets them split payments into installments, often tacking on a one-time interest and service fee as part of the amount due. BNPL has been shown to increase consumer spending, leading to lasting gains for retailers and BNPL providers. One report found that BNPL prompts more spending and increases how much a consumer spends per transaction by as much as 10%.

While this flexibility allows consumers to manage their cash flow and make big-ticket purchases on necessary items like appliances or furniture, it has also led to more consumer debt. This can quickly spiral, especially for those juggling multiple BNPL purchases, credit card debt, mortgages, and student loans.

04

Focus on financial wellness

While 3 in 4 millennials feel stressed about their finances, more than 61% also report feeling confident about their overall financial knowledge. This is partly due to how accessible information has become — search engines and platforms like YouTube have made it easier for the average consumer to learn about saving money and repaying debt.

While inflation, student loan repayment, and residual insecurity from the pandemic have left many feeling uncertain about their future, more than 60% of surveyed millennials are interested in using cryptocurrency and stocks as a way to grow their wealth for more financial security. Data from the World Economic Forum supports this trend — 70% of retail investors are younger than 45.

States are also taking a more active role in educating the next generation. More than 4 in 10 high school students will be required to take a personal finance class as a prerequisite for graduation. This is good news for Generation Alpha and younger members of Generation Z, who are reported to be far less financially confident than their older counterparts.

05

Changes in credit repayment patterns

While inflation has declined over the past few years, consumers remain concerned about price increases. This makes sense, as the cost of food alone has risen 28% over the past five years.

The number of consumers turning to credit cards and loans to navigate the higher cost of living has grown, contributing to a cycle of debt and repayment that many may find difficult, if not impossible, to break. Consumers prioritize flexible repayment options more than ever, and institutions that offer features like varying loan terms and income-driven repayment are better positioned to meet that need.

Banks can offer further intervention in the form of more personalized financial guidance and education to help people better weigh their options. A more informed consumer often translates to less risk for the financial institution.

06

Resumed negative reporting of delinquent student loans

Federal student loan repayment was put on pause in 2020 to help consumers stay afloat during pandemic uncertainty. Borrowers could continue making payments, but they would not be reported as delinquent if they did not. The 12-month "on-ramp" to help borrowers transition back to making payments has since ended, and the Department of Education will begin reporting late and missing payments for standard borrowers in January 2025. Loans will once again be at risk for default, which impacts borrower's credit scores and can trigger loans being sent to collections.

However, the rising cost of living and the addition of new debt have left many borrowers unable to afford repayment. Only 40% of borrowers successfully made a payment in April 2024, with 76% citing financial concerns as the cause. Reports indicate that delinquencies on non-student loan debt are also higher than before the repayment pause as many struggle to balance repayment — a trend worth noting for lending institutions.

How Array supports these trends

Set your organization up for lasting success with Array. We can help you navigate the ever-shifting landscape of consumer credit with tools like:

Integrations with digital platforms: Array products seamlessly integrate with your existing digital platforms through embedded, private-label, and API options. This means faster deployment for you and a better experience for your clientele.

Personalization features: Our Offers Engine lets you get into the thick of consumer data through segmented audiences and personalized, targeted offers.

Innovative credit solutions: We're built on the idea of using innovation to empower consumers with more control over their financial wellness through products like My Credit Manager, BuildCredit™ Rent, and BuildCredit Account.

Student loan aid: Our acquisition of Payitoff gives you access to more intelligent debt management options for consumers entering student loan repayment, saving users an average of $323 per month.

See these tools and more in action by requesting a demo today.

Stay ahead of shifting credit trends with embedded tools that deliver real value.

Book a 15-min call.

Disclaimer: Array takes pride in ensuring the information we share is accurate and up-to-date; however, we understand that the information you read may differ from the product(s) and/or service(s) mentioned. We present the product(s) and/or service(s) you read about without warranty. We recommend you review the product and/or services’ terms and conditions before you make a decision. If you encounter inaccurate or outdated information, let us know by writing to: info@array.com.

Editorial Note: This content is the author’s opinion, expression, and/or recommendation(s).

Tags:

Thought Leadership

Post by Amelia Chen

Amelia Chen is the Head of Marketing at Array, a leading embeddable fintech products platform company where she leads all of marketing. Prior to Array, she led product marketing for the corporate segment at Relativity, a legal tech and compliance software company. With a background in finance, sales, strategic partnerships and marketing, Amelia is passionate about understanding the market and finding the most effective and resonant ways to communicate with customers. Always seeking to learn more, Amelia holds an MBA from the Kellogg School of Management and earned her Bachelor's Degree from Northwestern University.