Staying relevant and delivering real value to your customers is about much more than offering traditional products.

It’s about understanding your customers’ entire financial picture and using that understanding to provide personalized, meaningful experiences. As a Director of Sales at Array, I’ve seen how leveraging credit data can transform the way banks and fintech companies engage with their customers—creating opportunities that go far beyond what account aggregation alone can offer.

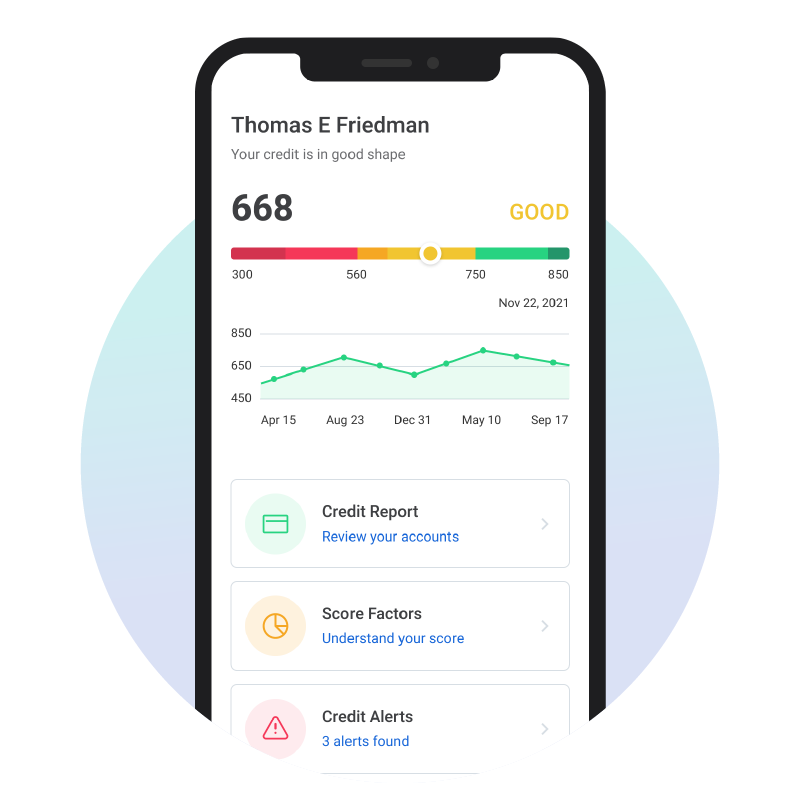

At Array, we provide embedded financial health products, including tools that help customers monitor their credit, safeguard against fraud and identity theft, and improve their credit scores. But beyond these features, credit data holds the key to unlocking a deeper, more complete view of your customers’ financial lives. Here’s why credit data is essential to your marketing strategy.

01

Credit data provides the full financial health picture

While account aggregation gives you a snapshot of the payments and transactions happening within the accounts your customers have connected, credit data tells a much more comprehensive story. It reveals a customer’s broader financial behavior, including their credit history, outstanding debts, and payment patterns across all of their financial obligations.

This expanded view allows you to understand not just what your customers are spending their hard earned dollars on, but how they’re managing their overall financial health. Are they consistently paying off their debts? Is their credit improving or declining? These insights are invaluable when crafting marketing strategies that truly meet your customers’ needs.

For example, if a customer has recently paid down significant debt and their credit score has improved, they may be more receptive to offers for mortgages, auto loans, or credit cards with favorable terms. On the other hand, if their credit has taken a hit, you can offer products aimed at rebuilding credit, showing that you’re supportive of their financial journey.

Your marketing is only as strong as your data. Credit signals can change everything.

02

Proper integration of credit data across all channels

To fully leverage credit data, it’s essential that this information is properly integrated and understood across all marketing channels. It’s not enough to have access to this data; marketers who are at the top of their game need to ensure that the data is consistently used in digital ads, their mobile apps, in-branch communications, emails, and even traditional mailers.

Consider a scenario where a customer receives an email with personalized marketing based on their credit improvement. When they log into your app or visit a branch, they should encounter consistent messaging that reinforces your marketing, creating a seamless and unified customer experience. This omni-channel approach, powered by credit data, not only enhances relevance but also builds trust and strengthens customer relationships.

At Array, we emphasize the importance of integrating credit data into every touchpoint. When your marketing strategy uses this data cohesively, you create a narrative that resonates with your customers, no matter how they choose to interact with your brand.

03

Credit data drives more relevant and approachable marketing

One of the key benefits of using credit data in your marketing strategy is the ability to ensure that the offers you present are not only relevant but also likely to be approved. Credit data provides the insights needed to match customers with the right products at the right time, based on their actual financial standing.

For instance, if a customer’s credit profile indicates they are in a good position to qualify for a mortgage, you can confidently market your mortgage product. Conversely, if their credit score is lower, you can focus on products that help them improve their credit, such as secured credit cards or credit-building loans. This approach not only increases the likelihood of approval but also shows your customers that you are attuned to their specific financial needs.

04

More than account aggregation: the power of credit data

While account aggregation is a valuable tool for understanding where your customers are spending and how they manage their connected accounts, it only offers part of the picture. Credit data, on the other hand, provides a more holistic view of your customers’ financial lives. It’s not just about the transactions they make—it’s about how they manage credit, debt, and their overall financial health.

This broader perspective is crucial for developing marketing strategies that are genuinely responsive to your customers’ needs. By understanding their full financial story, you can craft offers and communications that are more relevant, timely, and impactful—ultimately driving better engagement and stronger customer loyalty.

The bottom line: credit data is central to modern marketing strategies

Incorporating credit data into your marketing strategy is not just an enhancement—it’s a necessity. It provides the comprehensive insights needed to create personalized, relevant, and timely marketing that resonate with your customers at every stage of their financial journey. By properly integrating and understanding this data across all channels, you can ensure that your marketing efforts are consistent, effective, and truly customer-centric.

At Array, we’re committed to helping banks and fintech companies harness the full potential of credit data. Not only can a comprehensive data set help improve the financial health of your customers, but it can also drive growth and innovation in your marketing strategies. If you’re not already leveraging credit data as part of your approach, now is the time to start. The insights and opportunities it offers can make all the difference in building stronger, more loyal customer relationships—and staying ahead in the competitive financial services market.

Use embedded credit data to target smarter, personalize offers, and build lasting loyalty.

Book a 15-min call.

Disclaimer: Array takes pride in ensuring the information we share is accurate and up-to-date; however, we understand that the information you read may differ from the product(s) and/or service(s) mentioned. We present the product(s) and/or service(s) you read about without warranty. We recommend you review the product and/or services’ terms and conditions before you make a decision. If you encounter inaccurate or outdated information, let us know by writing to: info@array.com.

Editorial Note: This content is the author’s opinion, expression, and/or recommendation(s).

Post by Jacob Bouer

Jacob Bouer is the Director of Strategic Partnerships at Array, an embeddable fintech platform which helps fintechs and financial institutions provide engaging financial health tools to their customers. Jacob has spent the bulk of his career as an innovation strategist—focused on bridging the gap between technology companies and banking. Jacob has also worked with many fintech founders in the industry on go-to-market strategy in the banking market, specifically on how to partner with banking cores and digital banking providers. He currently lives in San Diego, but spends a lot of his time on the road at all the various fintech events. He’s passionate about networking and loves to surf!