Federal student loan payments were paused for nearly four years during the pandemic, creating a temporary drop in reported delinquencies. Because missed payments weren’t shared with credit bureaus, delinquency rates appeared much lower than they actually were. That changed in late 2023, when payments and reporting resumed. Now, delinquencies are beginning to surface again. In this post, we’ll explore what the data shows so far, what to expect in the months ahead, and how fintechs and lenders can take steps to reduce risk.

What the data shows so far

The resumption of student loan payments after extended forbearance periods is reshaping delinquency trends in real time. For several years, delinquency reporting was largely on hold, offering borrowers temporary relief but also masking underlying risk. Now that risk is reemerging.

Two key policy phases contributed to the suppressed delinquency data:

The pandemic payment pause

Student loan payments were paused for over three years to provide COVID-19 pandemic relief. During this time, individuals with existing loans received a 0% interest rate. Additionally, loan servicers did not report delinquencies to credit bureaus, resulting in delinquency rates dropping significantly.

The one-year "on-ramp" period

From October 2023 to October 2024, borrowers entered a transitional phase. Payments were technically due, and interest resumed, but servicers still did not report missed or late payments. This gave borrowers more time to adjust, while keeping delinquency rates artificially low.

In just the first quarter of the year,

more than one in four borrowers over 40

were reported as delinquent.1

The start of 2025 marked the reappearance of delinquencies on credit reports. In just the first quarter of the year, more than one in four borrowers over 40 were reported as delinquent.1 Meanwhile, 5 million borrowers qualified for $0 monthly payments, and over 20 million borrowers were not in active repayment.

Student loan balances have continued to grow, reaching $1.64 trillion in the second quarter of this year, according to the New York Fed, one of the highest levels seen to date.2 These early signals suggest that lenders and fintechs need to closely monitor forbearance exit behaviors, income-driven repayment plan adoption, and reentry patterns to identify borrowers at higher risk of default.

Why student loan delinquencies rise post-forbearance

With forbearance now behind us, many borrowers are struggling to reenter repayment. Several factors are contributing to the rise in delinquencies. For lenders and fintechs, understanding these drivers is key to supporting at-risk users.

-

Payment shocks: After nearly four years of paused payments, many borrowers are facing steep financial adjustments. Some reallocated funds elsewhere, while others, particularly first-time borrowers, are navigating repayment for the first time. The result is a sharp return to monthly obligations that many weren’t fully prepared for.

-

Servicer changes and administrative frictions: Servicers often transfer loans or undergo administrative updates during extended periods of forbearance. This can lead to widespread confusion; borrowers are unsure where to pay, how much they owe, or how to access their accounts. These frictions increase the risk of missed payments, even for those intending to pay.

-

Budget strains: Inflation and rising living costs continue to strain household finances. Many borrowers who relied on forbearance to stay afloat now face overlapping financial demands. Some may have taken on additional debt or other obligations during the pause, further increasing the risk of delinquency.

Help borrowers stay on track with smarter repayment options

What happens next

As student payments resume, the delinquency landscape will evolve. Knowing what to expect during the coming months is important for managing risks and supporting borrowers. Here's what we might see over the next year:

-

Near-term: Delinquency rates will likely continue rising over the next several months as servicers update borrower status and payment backlogs clear. We'll likely see a temporary spike as delinquencies previously masked by forbearance and administrative delays are now reflected in official data.

-

Mid-term: Delinquency rates may stabilize and gradually decline as more borrowers enroll in affordable plans such as income-driven repayment (IDR) plans. Fintechs and lenders should watch for increased enrollment in these programs and offer support to make enrollment easier.

-

Long-term: Long-term implications will depend on policy adjustments. IDR reforms, target relief measures, changes in servicing practices, and employment and wage trends will significantly impact delinquency rates. If labor markets remain or grow stronger and policy tweaks improve flexibility, we could see a downward trend in delinquency rates.

Risk mitigation for lenders and fintechs

As loan payments restart, lenders and fintechs face heightened delinquency risks. The following strategies can help teams mitigate these risks while empowering borrowers:

-

Implementing proactive outreach: Engaging with borrowers early and often can help mitigate delinquency risks. Outreach through personalized emails, notifications, and text messages can remind borrowers of upcoming due dates and explain available options. This support can help borrowers avoid or navigate challenges and provide an early-intervention strategy for identifying at-risk borrowers.

-

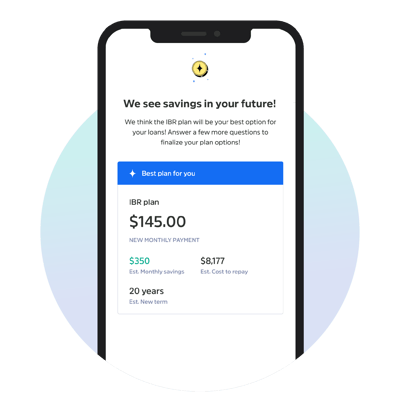

Offering frictionless plan selection: Simplifying the enrollment process is critical for mitigating delinquency risks. Lenders and fintechs should streamline digital workflows, provide clear instructions within platforms, and minimize paperwork to make the enrollment process easier. Making plan selection intuitive and accessible allows borrowers to find options that suit their financial situation while reducing confusion and frustration.

-

Providing budgeting aids: Providing personalized financial insights and budgeting tools can help borrowers manage their payments more effectively. For example, the U.S. Department of Education offers tools like loan simulators and grants to help borrowers make informed decisions. Features like payment calculators, spending trackers, automated reminders, educational content, and scenario planning can prepare borrowers for future payments.

How Array’s Student Loan Aid helps stabilize delinquency risk

Implementing a student loan repayment assistance platform can help you drive engagement, retention, and growth. Array’s Student Loan Aid offers embeddable guidance that lets users link student loans, see suggested plans, and take actions on your platform.

Array users can experience outcomes like:

-

Lower monthly payments via affordable federal programs

-

Faster paths to a current status after missed payments

-

Potential positive credit impacts

Student Loan Aid also offers several business advantages. As an outcome-driven solution, this platform supercharges deposits, amplifies user engagement, and increases customer retention.

Businesses that use Student Loan Aid can:

-

Retain deposits and deepen relationships as payment burdens drop

-

Improve borrower trust and loyalty

-

Create cross-selling opportunities

-

Reduce delinquency risk via earlier enrollment in suitable payment plans

Why trust Array to stabilize post-forbearance delinquency

At Array, we fuel financial security by delivering innovative solutions that complement existing product experiences. We help the world’s leading fintechs and financial institutions boost retention, drive growth, and achieve measurable results. We secured a spot on the 2024 Fintech Innovation 50 list, hold several awards and recognitions, and are backed by some of the most influential supporters.

Embed student loan guidance with Array

Extended loan forbearance has impacted delinquency rates, but proactive, embedded guidance can bend the curve. Mitigate risks with Array.

See how Student Loan Aid can help your borrowers and portfolios.

Book a 15-min call.

1 Student Loan Delinquencies Are Back, and Credit Scores Take a Tumble, Liberty Street Economics, May 2025

2 Center for Microeconomic Data, Q2 2025

Disclaimer: Array takes pride in ensuring the information we share is accurate and up-to-date; however, we understand that the information you read may differ from the product(s) and/or service(s) mentioned. We present the product(s) and/or service(s) you read about without warranty. We recommend you review the product and/or services’ terms and conditions before you make a decision. If you encounter inaccurate or outdated information, let us know by writing to: info@array.com.

Editorial Note: This content is the author’s opinion, expression, and/or recommendation(s).

Tags:

Thought Leadership

Post by Megan Fiato

Megan Fiato is a Field Marketing Associate at Array with a strong background in sales and marketing. She supports fintechs, financial institutions, and consumer-facing platforms by executing industry-specific marketing strategies that drive top-of-funnel growth and build brand visibility.

Megan is passionate about creating meaningful, in-person engagement that connects people to tools that improve their financial lives. She brings a hands-on, relationship driven approach to every campaign- helping bring Array's marketing programs to life through event execution, lead nurturing and demand generation support.

Megan is passionate about creating meaningful, in-person engagement that connects people to tools that improve their financial lives. She brings a hands-on, relationship driven approach to every campaign- helping bring Array's marketing programs to life through event execution, lead nurturing and demand generation support.