Updated 8/7/2025

Common wisdom says it pays to specialize, but that advice could be costly in the financial services industry. Diversifying your catalog with additional service offerings can help you take advantage of new opportunities to boost your business and prepare for the future.

Here's why your fintech or financial institution needs to consider the value of a consolidated strategy for your customers — and your bottom line.

Why a consolidated financial strategy is a win-win

Providing customers with the tools they need to consolidate all their assets under your roof benefits everyone involved. Consumers gain a better experience through advantages like these.

Reduced fees

Monthly service fees and transaction charges make dealing with multiple financial institutions costlier than many people anticipate. Consolidating their finances with your institution eliminates hidden costs, enhances the customer experience, and boosts loyalty.

Enhanced visibility

Holding money in several places makes it challenging to see the big picture and manage funds accordingly. Putting all their assets under one roof, or fewer roofs, can give customers complete visibility that helps them make more informed decisions.

Better financial advice

Consumers who simultaneously work with multiple financial advisors may receive conflicting advice that can cause them to make ill-informed decisions. Those with access to all the services they need will be more likely to entrust you with their complete assets, making it easier for your team to provide the best recommendations and generating more revenue for your organization.

Ultimately, a comprehensive, consolidated financial strategy can allow people to feel more confident in managing their finances, whether they have ambitious objectives or are new to money management.

The benefits of consolidation for financial services companies

Bringing more of your customers' financial assets under your umbrella of services benefits more than your customers — it's, of course, also a win for your fintech or financial institution.

Expanding your offerings can help with:

Increased conversions

You can attract a new customer base who may need something different by offering a diverse list of financial tools and services under one roof.

Improved retention

Expanding your product catalog adds value to your current consumers' experience, which can encourage them to stay with your company.

Innovation

Diversifying your offerings sets your company apart from your competition and establishes you as a leader, boosting your reputation and growing your business.

Help your customers cut through the noise with a simpler financial experience.

How to create holistic financial services

Giving your customers a 360-degree view of their finances is critical for meeting their needs. Here's a quick step-by-step guide that will walk you through creating a more comprehensive product offering for your customers.

01

Understand your customers' needs

The most critical step in this process is to know what your customers want and need from their financial partners. The information you collect here will inform your entire approach. Conduct research into the most pressing financial challenges your customers face today.

An anonymized survey can reveal answers to questions like these:

-

What financial concerns do your customers experience?

-

Which products or services are your most and least popular?

-

How do customers feel about your service?

-

What do customers consider when deciding which financial services provider to work with?

02

Evaluate your existing offerings and identify a solution

Once you know what your customers are looking for, compare your findings to your portfolio of financial products and services.

Consider the following questions:

-

What solutions would best accommodate your customers' needs?

-

How can you give people more of what they want?

-

Which products or services miss the mark on customer satisfaction?

Collaborate with your team to brainstorm potential solutions. What can you do with your current resources? Will you need to invest in other tools or infrastructure to implement your ideas?

03

Consider upgrading your software

Often, expanding your product offering requires some degree of investment into new resources like digital infrastructure, software, or even physical hardware.

Embeddable, user-friendly service components are an excellent option because you can integrate them directly into digital experiences like your app or website. For example, adding a personalized offers engine into your banking app can leverage user data to identify and recommend the best offers to each customer, guiding them toward their next wise financial move.

How Array can help

The customer experience is the deciding factor in convincing your account holders to trust you as their sole financial institution. After all, you can only offer your customers the tools and services you have available.

That's where Array comes in.

Our constantly growing product list includes embeddable and private-label software solutions you can easily integrate into your offerings. The fully customizable interface and seamless integration capabilities enable consumers to accomplish all their financial tasks directly within your digital experience, boosting trust and engagement.

You can also add value to the experience by diversifying your offerings with tools like these:

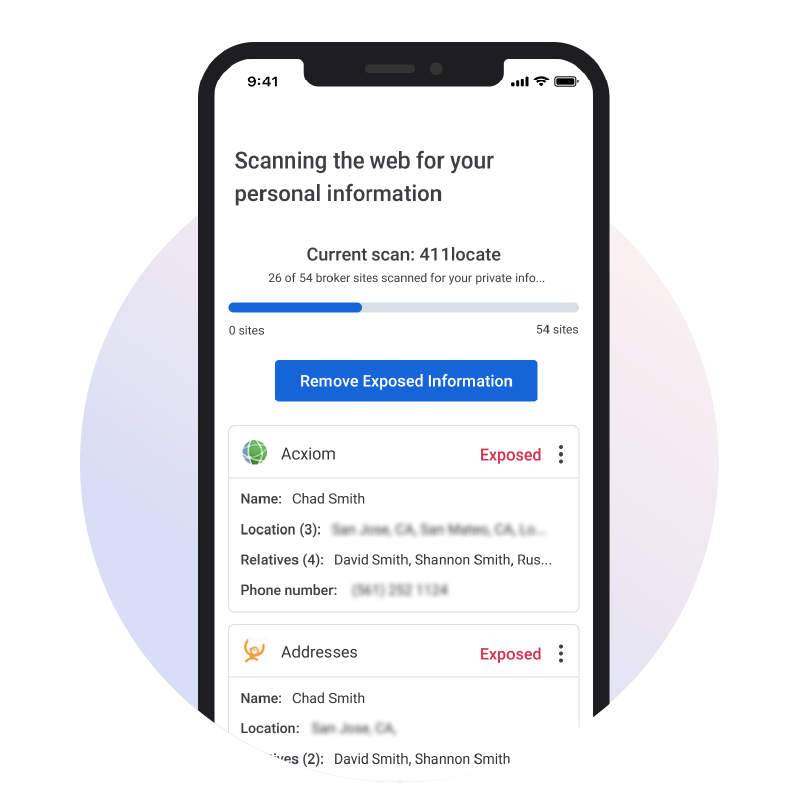

Privacy Protect:

This solution allows users to instantly find and remove exposed private information from people search and data broker sites, bringing their data back under their control. This service also builds customer trust by demonstrating your organization's commitment to personal security.

Subscription Management:

With this tool, customers can quickly view, edit, and cancel all their active subscriptions without ever leaving your digital experience.

Data Furnishing:

Array's Data Furnishing tool allows your organization to report multiple payment types — including student and personal loans, homeowners association dues, rent, and more — to the appropriate bureaus, allowing customers to track and monitor their payments without missing a beat.

We designed our solutions to integrate flawlessly into your organization's unique digital ecosystem, which is why we have strategic relationships with the credit bureaus: Experian, TransUnion, and Equifax. Enjoy more peace of mind when your new offerings work consistently, regardless of the provider you use.

Help consumers consolidate their financial strategy with Array+

Enhance consumer engagement and your value offering while creating a new revenue stream for your institution with Array+.

Array+ is a free-to-premium product suite designed to support your users' financial journey and help you generate non-interest income.

Here’s how Array+ works:

From within your digital experience, consumers have access to a click-through carousel displaying their critical financial information. They can explore each feature, learn what's available for free, and see what they'd gain by upgrading to the premium tier. Users can manage their plan, update billing, or un-enroll without leaving the tool, creating a smooth, user-friendly experience. By providing this convenience, you can build trust and empower users with full control of their financial environment.

Free product suite:

With Array+, your customers will have access to various free features:

-

My Credit Manager: Your consumers can review their credit score or upgrade to access more features, like credit alerts.

-

Identity Protect: Access free dark web monitoring, upgrade for more features, learn about identity protection, view their alerts, and see what information is being monitored. They also have the option to add additional personal information.

-

Personal Info Protection: Users can see how many pieces of their information are in the possession of data brokers and People Search sites.

-

Subscription Manager: Individuals can view all online subscriptions in one place.

-

Manage Account: Users can conveniently review their billing information, upgrade, and enroll from the product.

Premium product suite:

Consumers can upgrade to the Array+ premium suite for more control and protection. With the premium subscription, they have access to:

-

My Credit Manager: In addition to credit monitoring, users receive credit alerts from all three credit bureaus.

-

Identity Protect: Your consumers have more identity protection services, including ID theft insurance, Social Security Number monitoring, ID restoration and national change of address.

-

Personal Info Protection: Users can remove their exposed data from broker and search sites. The feature will continuously monitor and remove your sensitive information to ensure long-term protection.

-

Subscription Manager: Consumers can cancel their subscriptions with a tap, making managing their financial picture seamless within your digital banking experience.

-

BuildCredit Account: Build credit or establish credit history with an installment loan

-

Student Loan Aid: Enroll into federal student loan plans to drive potential savings

Give your customers the roof they want to stay under

Convincing your customers to keep all their finances under one roof means establishing your company as the most reliable option. Go beyond top-notch customer service by equipping your financial organization with the tools to become that one-stop shop.

Learn how to accomplish your goals by incorporating Array's solutions into your offerings. We can help you generate a fast ROI with our software's rapid implementation and deployment capabilities.

Be the single destination your users rely on for financial clarity.

Book a 15-min call.

Disclaimer: Array takes pride in ensuring the information we share is accurate and up-to-date; however, we understand that the information you read may differ from the product(s) and/or service(s) mentioned. We present the product(s) and/or service(s) you read about without warranty. We recommend you review the product and/or services’ terms and conditions before you make a decision. If you encounter inaccurate or outdated information, let us know by writing to: info@array.com.

Editorial Note: This content is the author’s opinion, expression, and/or recommendation(s).

Post by Cody Morrison

Cody Morrison is a dedicated Account Executive at Array, where he excels in managing client accounts and driving business success. With a strong background in sales and customer relationship management, Cody is known for his ability to deliver tailored solutions that meet the unique needs of his clients.

At Array, Cody leverages his strategic thinking and exceptional communication skills to build and maintain robust client relationships. His attention to detail and commitment to excellence ensure that he consistently meets and exceeds performance targets, contributing significantly to the company’s growth and reputation.

Outside of his professional life, Cody enjoys spending his leisure time golfing in his hometown of Myrtle Beach. Known for its beautiful courses and vibrant golfing community, Myrtle Beach provides the perfect backdrop for Cody to unwind and indulge in his passion for the sport. Whether he’s on the golf course perfecting his swing or strategizing to close the next big deal, Cody’s dedication and enthusiasm are evident in everything he does.

At Array, Cody leverages his strategic thinking and exceptional communication skills to build and maintain robust client relationships. His attention to detail and commitment to excellence ensure that he consistently meets and exceeds performance targets, contributing significantly to the company’s growth and reputation.

Outside of his professional life, Cody enjoys spending his leisure time golfing in his hometown of Myrtle Beach. Known for its beautiful courses and vibrant golfing community, Myrtle Beach provides the perfect backdrop for Cody to unwind and indulge in his passion for the sport. Whether he’s on the golf course perfecting his swing or strategizing to close the next big deal, Cody’s dedication and enthusiasm are evident in everything he does.