With an uncertain economic future ahead, many organizations are taking a hard look at their strategic priorities. Are they focusing on the right projects? Will they be able to weather the storm? How can they continue to attract and retain customers amid hardship?

For fintech companies, innovating against a backdrop of an impending recession doesn't have to mean coming up with the next big thing. It can also mean doubling down on meeting customers where they're at and providing relevant fintech services. Fintechs must consistently track progress toward their goals without losing sight of customers and their needs.

Below, we'll explore how fintechs are balancing innovation and adding value for their customers and bottom line amidst economic turbulence.

Increasing paid conversions

Creating value that consumers will pay for means building the products that address their most pressing pain points—a fundamental principle that the most forward looking, innovative fintechs appreciate. These companies aren't asking themselves, “How can we convert more customers?” Instead, they're reframing the question to “What are the biggest financial challenges customers face, and how can fintechs help?”

During this time of economic hardship for many Americans, the fintechs leading the way are corralling their teams to break down the financial wellness challenges their consumers are grappling with today.

Now, we're seeing all types of fintechs investing in financial wellness in various ways. Here are a few examples:

-

Origin and workplace financial education: Origin, a company offering workplace financial wellness tools, recently acquired financial health startup Finny, which focuses on educational content. Origin's workplace tools will soon incorporate Finny's resources on financial education, such as a curriculum and debt management tools, into its platform to promote financial literacy. Workers using Origin will be able to learn more about staying financially healthy and how to use Origin's tools to their fullest potential.

-

Sorbet and on-demand cash advances: Sorbet is a fintech platform offering paid-time-off (PTO) solutions. It announced a new product that will allow employees to access the cash value of their PTO as they accrue it. Workers can access more of their compensation when needed and avoid risky financial situations. Sorbet found that the average American worker has over $3,000 in PTO at any given time, and this service can help them avoid using payday or personal loans to cover necessary costs that may arise1.

-

Moneyhub and MX partnership: Moneyhub and MX Technologies, Inc. are financial wellness companies partnering up to champion the concept of open finance. Open finance involves sharing financial data to drive innovation and improvement in the industry and is commonly adopted in Europe and Australia. MX serves North American businesses, while Moneyhub serves European ones. This new partnership will allow them to make referrals, share resources and accelerate the adoption of open finance across North America and Europe.

The need to convert more and more customers to paid products can be enticing but it can also leave existing customers behind. By reframing the goal of conversion to one of adding value, fintechs can avoid prioritizing revenue at the expense of their customers while still increasing conversions. It allows you to get the best of both worlds.

Take Origin and Finny, for example. By adding Finny's financial education resources to its existing financial wellness platform, Origin was able to offer a product that draws in more customers and helps existing ones, building loyalty and value right into its primary product. Existing customers receive more value, while new ones are drawn to the financial health education feature of the platform.

This acquisition is also a perfect example of how fintech firms don't need to — and shouldn't — spend limited resources building revolutionary new products. Developing new products is a costly endeavor and, in many cases, simply unnecessary. Instead, fintechs can partner with a solutions provider with existing expertise in building these products.

For example, if fintechs are looking to offer a tool that helps protect customers from privacy threats, they can lean on an existing solution. Our product, Privacy Protect, allows customers to scrub personal information from the internet and was built for easy deployment and integration. Privacy Protect users see increases in paid conversions and user engagement—all achieved through affordable solutions already available. Fintechs can add this value-building tool to boost conversions without time-consuming and costly development processes.

Increasing customer engagement and reducing churn

Another pressing issue for fintech firms is customer churn, especially in uncertain times when customers have many financial provider choices. The question here becomes, “How can we deepen customer engagement and deliver even greater value to keep customers coming back?”

The answer will look different for every company, but sticky products have emerged as the golden standard for customer engagement. A sticky product is simply one that creates repeat users. It might be a necessary part of someone's money management routine or something they enjoy doing every day. The stickier the product, the more your users get attached to it. Ideally, they'll even start raving about the product and draw more people to it.

We can illustrate stickiness with two of our products:

-

My Credit Manager: Array's My Credit Manager gives customers various credit score tools, like monitoring2, alerts, factors, simulations and dispute guidance. Many users interested in their credit score are looking to improve or maintain it—both of which take months, if not years, and require ongoing review. As customers work on improving their credit scores, they'll keep coming back to My Credit Manager to take action and understand it. It's a sticky product that requires them to return to the platform to reap its benefits.

-

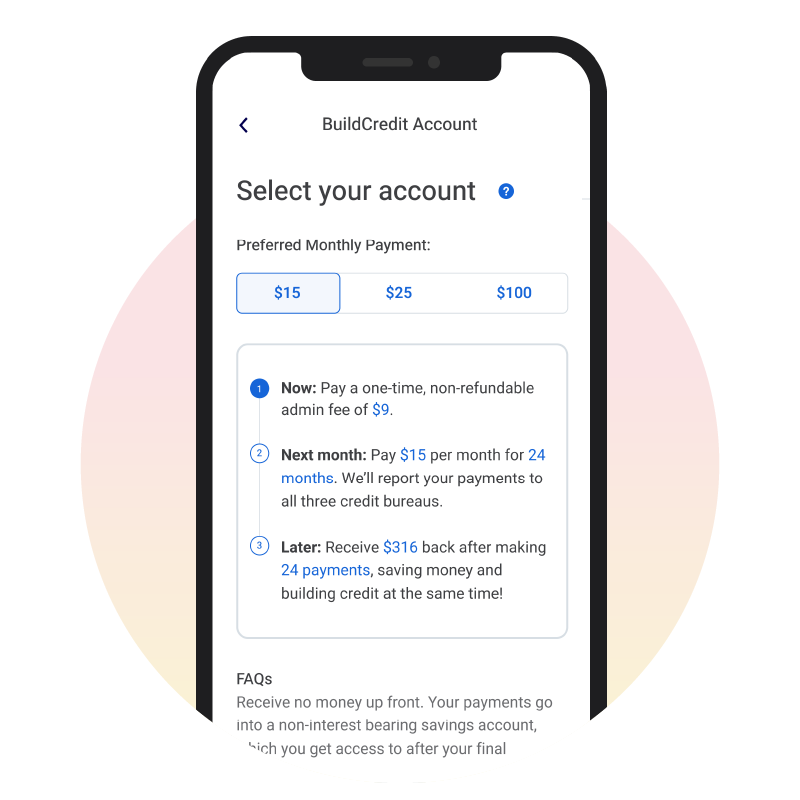

BuildCredit Account: This product helps customers establish credit scores and build their credit history through a loan. It's a great way to boost engagement and retain your customers who might be at risk of churn. Like My Credit Manager, it keeps people coming back to monitor and build credit, but it also provides a path for new customers that facilitates deeper loyalty and the use of other products. After building their credit, they've connected with your company and are ready to use your other services.

Some other examples of sticky products might include budgeting apps the user returns to every week or mobile payment systems that provide convenience. In comparison, services like insurance approval are more of a one-time deal. You may have repeat customers, but the service isn't used regularly.

Unsurprisingly, sticky products can keep your customers engaged and help reduce churn. Any fintech company evaluating potential products to build or buy should consider its stickiness. Assess how the product will contribute to customer engagement and churn reduction.

Here’s how leading fintechs are scaling smarter—without compromising innovation.

Diversifying and innovating

Fintechs across the board are looking to diversify and innovate. Many leaders are strategically assessing their roadmaps and looking to diversify their product portfolios in light of the increasing capital costs. Some fintechs, like mobile payment services and buy-now-pay-later solutions, are looking at the competition and asking how they can be different. Meanwhile, financial wellness startups are searching for other channels to generate cross-sell opportunities, non-interest income and subscription revenue.

The question that should really be the driving force behind portfolio diversification is, “How can we give customers more of what they need?” Fintechs can win big by diversifying their offerings with revenue-driving value-add products. Providing more solutions relevant to your customers can appeal to their needs and solidify your firm as a one-stop shop. When you can offer more desirable services, you can save them from adding yet another app or service to their repertoire.

Two great examples of the potential of diversification are Lending Club and Affirm:

-

Lending Club: Lending Club started as a peer-to-peer lending service and now offers everything from loans and bank accounts to investment solutions. In becoming a more traditional marketplace bank, Lending Club has facilitated over $75 billion in loans and served more than 4 million members. It's a much more versatile solution that supports customers with more types of services in one place.

-

Affirm: Similarly, payment solutions provider Affirm has expanded from supplying short-term loans and payment plans to offering a debit card and a high-yield savings account. These services align with the financial needs of Affirm's customers and helped the company grow.

Many of our clients use unique solutions like Subscription Manager or Identity Protect to add variety to their product offerings. Subscription Manager offers a compilation tool to help customers pare down and monitor their subscriptions. Identity Protect helps mitigate identity theft concerns through detailed monitoring. Both options provide uncommon products that pair well with other fintech tools. They're a great value-add that clients often appreciate as a bonus to other services.

Fortunately, diversifying a portfolio might not require significant resources from fintech firms. Rather than building these products in-house, fintech companies are leaning into mergers and acquisitions and strategic partnerships. As outlined by White & Case, the fintech industry is poised for these deals, which are ideal for growth and diversification.

Remember, innovation doesn't require revolutionary products. Diversification can help you give customers more of what they want and need without trying to invent some game-changing concept. Simply offering the right solutions can be game-changing in its own way.

The case for consolidation

If we look at the driving forces behind these three strategic goals we've discussed, a common theme emerges. To review, here are the questions many firms seek to answer when accomplishing these goals:

-

Increasing conversions: What are the biggest financial issues that customers face today, and how can we help them?

-

Reducing attrition: How can fintechs deepen customer engagement and deliver even greater value to keep their customers returning?

-

Diversifying and innovating: How do we give customers more of what they need?

All of these questions point toward the need for consolidation. As the fintech market grew and startups began to replace unsatisfactory services from traditional banks, finance became increasingly fragmented. Consumers might have a checking account through one company, a savings account through another and an investment account through another. Now, consumers can have anywhere from 20-30 financial management apps to support their financial ecosystems.

When a consumer's entire financial experience is separated across different platforms, they often have difficulty managing their money. They can't get the entire picture in one place, making budgets, payments and other tasks more challenging. They might forget payments or misunderstand how interest works in one account, leading to frustrating results.

One of the primary advantages of traditional banks is their one-stop shop nature, but as fintech firms begin to consolidate and offer similar services in one place, the need for old-fashioned banks diminishes. Instead, consumers know they can get benefits like personalization, zero friction and social and environmental consciousness through fintech companies.

Consolidation allows fintech companies to offer the whole package, providing the one-stop shop and services that consumers need. It also helps you leverage the resources of one service to improve the experience in another. For example, you might offer a money management platform that incorporates information from the customer's transaction history, which you can access through their linked credit and debit accounts, also offered by your company.

With so much potential, consolidation can help fintech firms build security and resiliency, which can help them withstand an unpredictable economic environment.

Managing limited resources

Many fintech firms aren't prioritizing adding new features to their repertoires, instead choosing to optimize their current feature sets. In a time when many Americans face financial hardships and many fintech firms are pulling back, fintech organizations have an excellent opportunity to truly double down on how they serve customers. It's time to meet customers where they are and provide solutions to help them through difficult times.

Deploying resources to build proprietary products — simultaneously expending development resources and accumulating technology debt — is often not the answer. Instead, look for platform solutions that can offer your company what it needs to stay ahead of the curve at a fraction of the cost.

Opting for platform solutions over point solutions — or individual, fragmented systems — is a crucial part of the puzzle. Integrated platforms can provide access to a plethora of programs, all drawing from shared IT resources and data. This centralized design can help minimize errors, reduce complexity and save on operational costs associated with managing multiple point systems. It offers a cohesive and seamless solution that consumers expect and allows you to leverage the capabilities of each one to provide a more personalized experience for the user.

Platform solutions can help you innovate while pouring gasoline on the fire of what makes your company great. For example, a fintech lender might add tools that help bring in more customers and boost engagement, which in turn drives more loans.

Boost innovation with Array

Innovation looks different for every company, but with the right approach, you can increase conversions, engagement and diversification without expending precious resources.

At Array, we offer an embeddable platform designed for fast implementation, flexible deployment and simple security. Choose from products related to building and managing credit, protecting privacy and customer identities and managing digital finances. Our ready-to-launch financial products allow fintech companies of all types to expand their offerings and give customers the tools they need.

Expand your offering without stretching your team or budget.

Book a 15-min call.

Related articles

1 Fintech Startup Sorbet Announces New Financial Wellness Benefit with On-Demand Casd Advance for Unused PTO, June 2023

2 Credit information could take up to 3 business days to be available for your consumers.

Disclaimer: Array takes pride in ensuring the information we share is accurate and up-to-date; however, we understand that the information you read may differ from the product(s) and/or service(s) mentioned. We present the product(s) and/or service(s) you read about without warranty. We recommend you review the product and/or services’ terms and conditions before you make a decision. If you encounter inaccurate or outdated information, let us know by writing to: info@array.com.

Editorial Note: This content is the author’s opinion, expression, and/or recommendation(s).

Helping to reshape the world of fintech, Casey collaborates with top founders and product leads, revolutionizing user interactions by enabling customizable financial wellness experiences. With an extensive background in fintech, Casey is passionate about helping fintechs create more meaningful relationships with their users through the latest innovations.

An Amherst alumnus, he currently lives in New York and enjoys traveling to new places.