As a financial content creator, you’re not just sharing tips and advice—you’re building a community that trusts you to help guide their financial journey.

What if you could offer personal finance tools that empower your followers beyond your content?

Financial tools like credit monitoring, identity protection, and privacy protection are all spokes in the complex wheel that is the collective approach to our financial empowerment.

Essentially, we all want to feel financially protected but it’s difficult to know where to start.

Well, it could start with you.

By integrating these personal finance tools into your platform, you can create deeper engagement, diversify your revenue streams, and offer real value that keeps your followers coming back.

Here's why this is powerful:

01

It's time for action

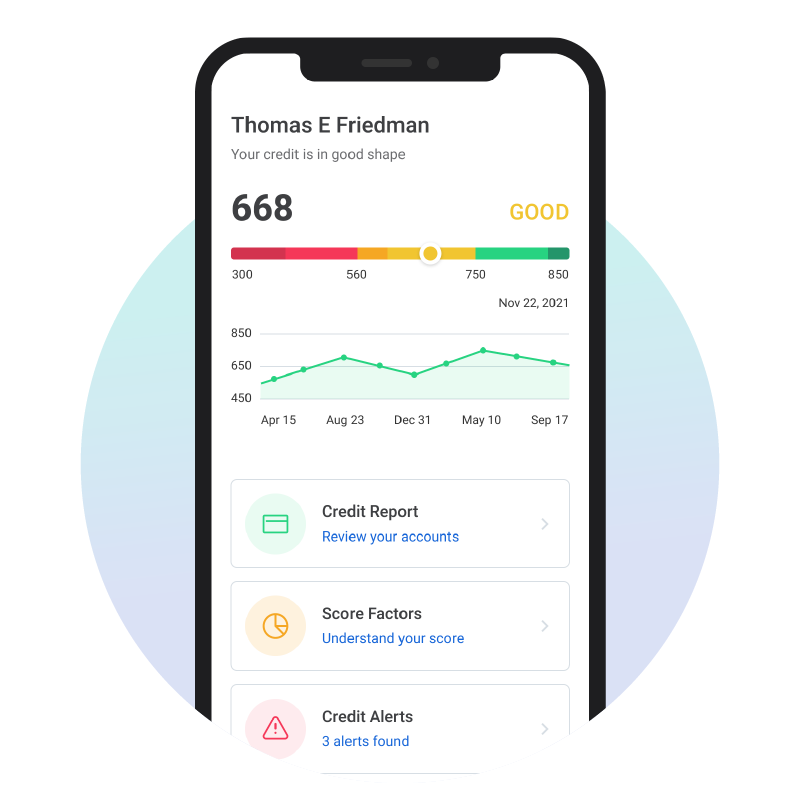

Your advice helps your followers make informed financial decisions, but what if you could offer them the tools to act on those insights immediately? With Array, you can provide followers access to credit scores, reports, debt analysis, and more—all embedded within your own branded experience. This gives your audience a one-stop shop for managing their credit and finances directly from your platform.

02

Loyalty, loyalty, loyalty

Offering personal finance tools isn’t just about functionality; it’s about turning your guidance into tangible outcomes. When your followers can track their credit score, receive alerts on identity theft, or monitor their privacy, you’re giving them the power to take control of their financial future. This cultivates trust and deepens the connection between you and your community. Sounds like a win.

You’ve built trust with your audience. Now turn it into lasting impact.

03

Money talks

While sponsorships and affiliate partnerships are great, adding a private-labeled product platform to your offerings can unlock new revenue opportunities. With Array, you can earn from subscription upgrades and share in the revenue, turning your financial expertise into a profitable venture. Plus, the data insights provided by these tools can help you deliver higher-value leads to your brand partners.

04

Trending up

The personal finance landscape is crowded, and standing out means offering something beyond great content. By integrating Array’s financial tools, you set yourself apart as a thought leader who doesn’t just talk about financial health but actively provides the resources to improve it.

05

The power of data + you

Financial influencers who offer personal finance tools can tap into a wealth of consumer data that drives personalized content and offers. Array’s suite of products allows you to see key financial attributes that can inform your content strategy, helping you create even more targeted and impactful guidance for your audience.

What does this mean for your followers?

Confidence? Check.

Security? Yep.

A better sense of financial control? Absolutely.

If you’re attending FinCon this October, stop by our booth to learn more about how Array can help you integrate these must-have financial tools into your platform.

Ready to offer your followers more? Empower your followers—and your brand—with Array.

Support your followers with tools that build real financial confidence.

Book a 15-min call.

Related articles

Disclaimer: Array takes pride in ensuring the information we share is accurate and up-to-date; however, we understand that the information you read may differ from the product(s) and/or service(s) mentioned. We present the product(s) and/or service(s) you read about without warranty. We recommend you review the product and/or services’ terms and conditions before you make a decision. If you encounter inaccurate or outdated information, let us know by writing to: info@array.com.

Editorial Note: This content is the author’s opinion, expression, and/or recommendation(s).

Post by Clint Gausnell

Clint is an engaging and accomplished Sales Executive whose award-winning efforts have driven explosive growth in fast-paced, high-pressure environments for established and startup enterprises. He is passionate about ensuring his clients’ success by delivering highly effective global sales strategies that produce results. Clint currently leads Array's Client Services sales team and lives in UT.